Import From China

Import From China

How to Import from China to Uruguay: A Complete Guide(Updated September 2025)

Import From China

Import From China

Finding trustworthy and reliable suppliers in China plays a critical role in ensuring that the importing process runs smoothly and effectively. It is important to have reliable partners when sourcing products, as they can greatly impact the quality and timeliness of the goods being imported.

You need sanitary and phytosanitary certificates for food, plants, and animal products from MGAP or AFIDI. There is also MSP registration for medicines and medical devices. Special permits may be needed for pesticides and animal feed. These are handled through VUCE, MGAP, and MSP processes. They are often necessary before getting clearance.

Importing from China to Uruguay is an exciting opportunity for entrepreneurs. With the growth of international trade, Uruguayan companies have access to innovative and competitive products. However, the import process can be complex and challenging.

This guide is designed to help you navigate the import process from China to Uruguay. We'll cover all the important aspects, from product selection to customs clearance. Our goal is to provide you with the latest and most relevant information as of September 2025.

Get ready to expand your business and capitalize on international trade opportunities. Let's get started!

Importing products from China to Uruguay has become essential for many companies. In 2025, this trend continues to strengthen due to several economic and trade reasons.

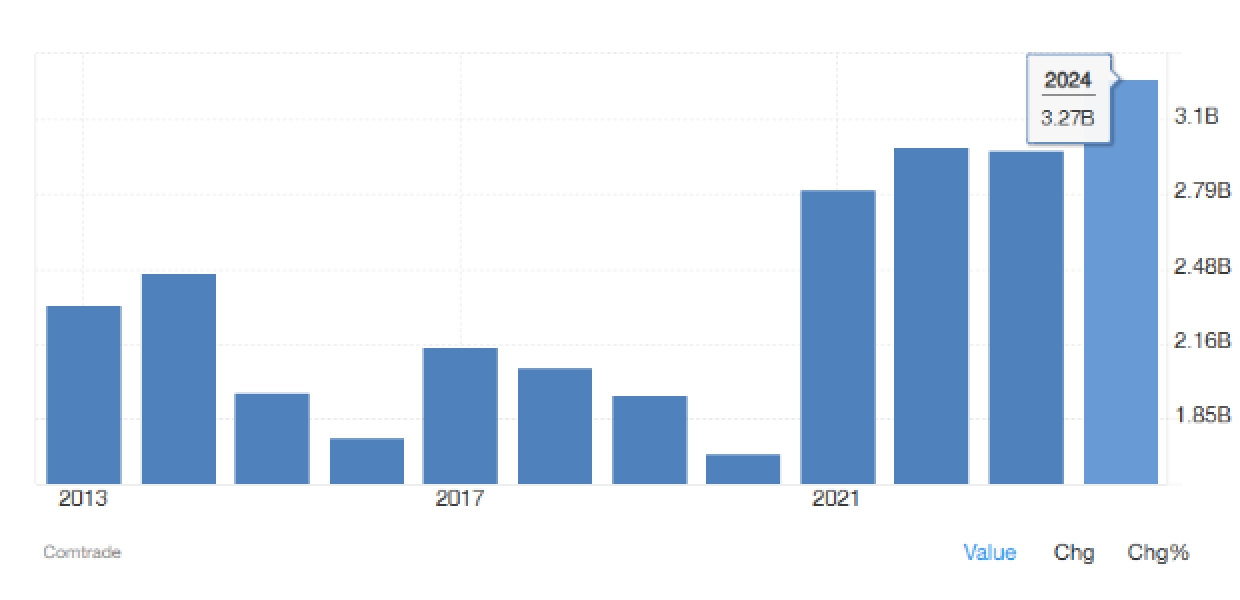

China's Exports to Uruguay were US$3.27 billion during 2024, according to the United Nations COMTRADE database on international trade.

China, as a global manufacturing leader, offers a wide range of products at competitive prices. As a wholesaler or retailer, importing from China now is your best opportunity.

For Uruguayan companies, importing from China means access to advanced technology and quality products. This not only improves product offerings in the local market but also allows businesses to compete more effectively. In a globalized world, staying competitive is essential, and China provides the inputs necessary to achieve it.

Benefits of importing from China:

Diversification of suppliers and products.

Access to innovations and advanced technology.

Cost reduction through lower-priced products.

Improved competitiveness against other local businesses.

Additionally, the strengthening of trade relations between Uruguay and China opens new opportunities. Trade agreements make transactions easier by reducing tariffs and simplifying processes.

Importing from China is important for Uruguayan companies. It helps them grow and compete in the international market. Seizing these opportunities in 2025 can be crucial for long-term business success.

The first step to importing from China to Uruguay is conducting thorough market research. Understanding Uruguayan consumer needs and preferences is crucial for making informed decisions. Only then can you ensure the imported product has demand in Uruguay.

It's essential to identify sectors with high demand and low competition. This not only increases the chances of success but also helps maximize profit margins.

Using market analysis tools can provide valuable insights into current and future trends. The key is identifying opportunities before others do.

Three ways to analyze market trends:

Digital analysis tools: Google Trends, TikTok Shops, AMZScout.

Social trends: Instagram, TikTok influencers.

Hire a sourcing agent: EJET Procurement.

Once the right market is identified, the next step is product selection. This choice should be based on factors such as quality, price, and market popularity. It's also important to consider Uruguayan regulations that may affect the import of the chosen product.

Factors to consider when selecting products:

Market demand: Does the product have an established market?

Regulations: Does it comply with Uruguayan laws and regulations?

Import costs: Is it financially viable after all expenses?

Reliable suppliers: Is there access to trustworthy manufacturers or suppliers?

Market research and product selection should not be taken lightly. It requires time and effort, but it's a critical step to ensure successful imports. Take the time to evaluate your options and strategies before moving to the next step. If you're unsure about choosing a niche, seek guidance from EJET Procurement.

Identifying dependable suppliers in China is a crucial step for anyone looking to import goods successfully. These suppliers are essential in making sure the products you get meet your quality, availability, and pricing standards. Establishing strong relationships with reputable suppliers can help create a smooth import process, ultimately leading to greater success in your business endeavors.

Start with online platforms like Alibaba and Global Sources to get an initial list of manufacturers. These platforms provide filters to find certified suppliers who meet international standards.

Once you identify potential suppliers, it's crucial to verify their credibility. Review their credentials, such as business registration certificates and export licenses. Direct communication also helps assess their ability to meet your specific needs. Asking for quality certifications or third-party audits can be an effective safety measure.

Consider visiting trade fairs in China. Events like the Canton Fair are excellent opportunities to meet suppliers in person and evaluate product quality. Trade shows also allow you to observe market trends and open direct negotiation opportunities.

If you can't travel, hiring agents in China for factory visits is another option. EJET Procurement offers professional Canton Fair visit services.

Key points to verify suppliers:

Certifications: Ask for proof of quality certifications.

References: Request references from past clients.

Track record: Verify how long they've been in business.

Capabilities: Ensure they can meet your required volumes.

Verifying supplier reliability not only ensures product quality but also minimizes fraud risks. Only once you're confident a supplier can meet expectations should you proceed with negotiations. This due diligence is important for establishing a strong, enduring business relationship.

Dealing with Chinese suppliers differs notably from doing so in Uruguay. Understanding these cultural differences in business is essential. It's more about building trust and lasting relationships than sealing quick deals.

When negotiating, it's important to be respectful and patient. Chinese people value face-to-face meetings where personal relationships can be created. If you can, visit China to hold negotiations; it shows genuine interest and dedication.

Tip: Pay attention to body language and manners during conversations.

Your success might rely on adapting to their negotiation style. Consider these suggestions for handling cultural differences:

Communication: Keep your tone formal and avoid direct language that might appear aggressive.

Patience: Be ready for negotiations to take a while, often involving lengthy meetings.

Flexibility: Be open to making concessions and finding creative solutions.

Following these practices can help you break cultural barriers and build strong relationships. Success in negotiations is not just about the final price but also the strength of the business bond formed. By focusing on these connections, you'll likely see greater long-term rewards.

Protecting intellectual property (IP) when importing from China is crucial. Lack of protection can result in significant losses. Before importing, ensure your products are registered and protected in both countries. Familiarize yourself with Chinese and Uruguayan IP laws.

Steps to protect your IP:

Register patents, trademarks, and copyrights.

Consult an international trade attorney.

Review contracts thoroughly.

Include specific clauses on IP protection in supplier agreements.

Additionally, monitor your supplier throughout the cooperation period. Supervise how your products are used in the market. These strategies minimize the risk of unauthorized use of your IP.

Incoterms are fundamental international trade terms. They define the responsibilities of buyer and seller during a transaction. Understanding Incoterms is crucial to avoiding misunderstandings in the import process.

They determine delivery, risk, and costs. Choosing the right one can significantly affect total import costs. For example, EXW (Ex Works) places most responsibility on the buyer, while DDP (Delivered Duty Paid) means the seller assumes almost all obligations.

Common Incoterms:

EXW (Ex Works): Minimum seller responsibility.

FOB (Free on Board): Seller loads onto the ship; buyer handles the rest.

CIF (Cost, Insurance, and Freight): Seller covers shipping and insurance to the destination port.

DDP (Delivered Duty Paid): Seller assumes all responsibilities and costs.

Clear purchase conditions help both parties align, making the import process smoother and more efficient.

Choosing the right shipping method is vital. Sea and air freight each have advantages and disadvantages. Consider your specific needs, such as timing and budget.

Sea freight: More economical for large shipments, handles high volumes, but is slower.

Air freight: Fast, ideal for high-demand or time-sensitive products, but more expensive and limited in volume.

Key considerations:

Cost: Sea is cheaper but slower.

Delivery time: Air is fast but costly.

Volume & weight: Sea handles large volumes; air has size limits.

Urgency: Choose air for urgent deliveries.

|

Type |

Cost |

Time |

Best for |

|

Sea Freight |

$3500/20-foot container |

35-45days |

Larger shipments |

|

Air Freight |

$8.00 per kg |

10-12days |

Urgent or high-value goods |

|

Express |

$20-$30 per kg |

3-5days |

Urgent shipments |

Analyze your product characteristics and logistics needs. The choice between sea and air shipping significantly impacts costs and timelines. If you need freight forwarding services, EJET Procurement is an expert in this area.

Customs clearance is a vital step. Compliance with Uruguayan customs regulations is required to ensure legal entry. You must know the required documents and procedures.

In Uruguay, you must declare all commercial imports using the Documento Único Aduanero (DUA) via the Aduana's electronic system, known as LUCIA/RADE/DAE. Declarations are normally lodged by a licensed customs broker (Despachante de Aduana). Key commercial and regulatory documents must be uploaded before/upon arrival to avoid delays and fines.

Working with a China sourcing agent is beneficial, as they handle customs clearance professionally, ensuring proper documentation and minimizing costly delays.

Key documents for customs clearance:

Commercial invoice: full description, unit price, totals, Incoterm, exporter/importer details.

Packing list: weights, dimensions, carton/box breakdown (mandatory for containerized cargo).

Bill of lading: transport document.

Certificate of origin: equired when asking for preferential treatment or to meet regulatory conditions. (Note: China to Uruguay shipments generally do not receive Mercosur preferential treatment; check origin rules for each case.)

Import permit (for certain products): You need certificates for food, plants, and animal products from MGAP or AFIDI. For medicines and medical devices, register with MSP. To use pesticides or animal feed, you also need special permits. These are handled through VUCE, MGAP, and MSP, and you typically need them before approval.

Understanding and complying with customs regulations is crucial to avoiding penalties or legal issues. Stay informed of any regulatory changes and be prepared. Without the correct documentation, you could face fines or have your shipment detained.

Tip: Consider training or consulting a reliable source to stay up-to-date on customs policies. This will ensure a smoother and more efficient import process.

Accurate calculation of import costs is crucial for business viability. Costs consist of several parts, with tariffs being a key element.

In Uruguay, tariffs depend on the type of product imported. Besides tariffs, VAT and other taxes apply. These amounts vary depending on trade agreements in effect between Uruguay and China at the time of import.

Accurately calculating import costs is crucial for maintaining business viability. These expenses consist of various elements that need to be thought about ahead of time.

Import duties play a significant role in these calculations.

To help you with this process, here's a list of the main tax components you must budget for (Uruguay):

Import duty (customs/GCD / MFN or specific): Uruguay charges a tax based on the value of goods when they arrive. The rates vary from 0% to 35%, with an average of about 9% to 10%. The specific rate you pay depends on the type of product, which is identified by its HS code.

Import VAT (IVA): The general VAT rate is 22%. Some essential items have a reduced VAT rate of 10%. For imported goods, the VAT tax base includes the customs value (CIF) plus any customs duty. There is also a system for advance or partial payments of import VAT. The advance payment can vary based on the type of product. For example, it might be 10% for general items and 3% for those with a reduced rate.

Consular duty / consular fee: commonly 3% for Mercosur origin and 5% for other origins (applies to “valor normal en aduana” / invoice value) — check for updates/exceptions.

Customs Service Fee (TSA): 0.2% of value (capped; e.g., max USD 50).

Customs Extraordinary Duty / other levies: Certain shipments incur an additional flat-rate charge based on a predetermined scale, which adds fixed amounts to the total.

Broker fees, handling, inland transport, port charges, storage, insurance: variable (broker fees often ~1% of CIF as a rule-of-thumb in local practice).

Understanding these elements helps set competitive prices and adequate margins. Research tariffs thoroughly to avoid financial surprises.

When your products reach Uruguay, having a proper receipt is essential to ensure everything is correct. Begin by checking the shipment to confirm the products align with what was agreed upon. This step is crucial for maintaining quality.

Quality control is vital for preventing problems with customers. Setting up a quality control system helps spot defects quickly. Make sure each product batch undergoes a thorough inspection.

Effective inventory management is key to your operation's success. Here are some steps to improve this process:

Logging: Record every inventory item coming in and going out.

Product rotation: Apply a "first in, first out" strategy to keep products fresh.

Constant monitoring: Use technology to keep track of inventory levels in real time.

Lastly, proper storage is important to maintain product quality. Choose a secure and well-equipped storage locati0n. This helps prevent spoilage and makes accessing products easier when needed.

Importing from China can come with its own set of risks and hurdles. One way to reduce these risks is by thoroughly checking out any supplier before you lock in a contract. Look at references from other clients and confirm the supplier's legal status using official documents.

Using detailed contracts that lay out all the terms and conditions clearly is another effective method. Make sure everything is documented in writing to avoid any misunderstandings. It's also crucial to think about protecting intellectual property rights from the start.

Here are some recommended steps to lower risks:

Pre-audits: Visit the supplier's site to check out their facilities and operations.

Staged payments: Make payments in parts, based on the completion of certain milestones.

Tip: Keep clear and direct communication with the supplier throughout the importing process. Building a relationship based on trust and collaboration can help reduce the risk of fraud.

Bringing in goods from China often requires a considerable amount of money. Because of this, it's important to have ways to keep cash flowing smoothly. Businesses have several ways to finance their importing activities.

One common option is trade lines of credit. These allow companies to pay suppliers before receiving and selling the goods. Another option is factoring, which provides cash advances on outstanding invoices.

EJET Procurement offers a credit payment service that can help you manage cash flow. This term lets you direct money toward other important needs, which might increase your financial flexibility.

Choosing the right financing option depends on what your company needs and its financial state. It's important to look into each option carefully before making a choice. Doing so will help you manage your imports smoothly without running into financial issues.

Importing from China to Uruguay can be challenging, but with the right approach, it becomes a strategic advantage. The key lies in solid planning and effective communication with Chinese suppliers.

Ready to source from China to Uruguay? Contact us for a free quote.

Related reading: How to import from China to Mexico.

A: You will need to have a commercial invoice, packing list, bill of lading, certificate of origin, and sometimes special import permits. Additionally, an import declaration is necessary for customs clearance.

A: In Uruguay, nearly all shipments are taxed. However, small packages valued under $50 are typically not subject to these taxes. For more substantial purchases, a VAT rate of around 22% is applied, and tariffs may also be required based on the type of product being imported.

A: You have the option to select sea freight, which is less expensive but slower, air freight, which is quicker yet costly, or couriers. Your decision should be based on how much you are shipping, the cost, and how quickly you need it.

Your trusted partner for sourcing from china.