Import From China

Import From China

How to Import from China to Colombia: A Complete Guide(Updated September 2025)

Import From China

Import From China

Finding dependable suppliers in China is crucial for a smooth and effective importing process. Having trustworthy partners is key, as they influence both the quality and timing of the goods imported.

Importing from China to Colombia is an exciting chance for business owners. As international trade expands, Colombian businesses can tap into innovative and competitive products. Yet, the import process can be complex and challenging.

This guide aims to help you manage the import journey from China to Colombia. We will explore all critical points, from product selection to getting through customs. We aim to provide you with the most current and relevant information as of September 2025.

Prepare to grow your business and seize international trade opportunities. Let's begin!

Importing products from China to Colombia has become crucial for numerous businesses. By 2025, this trend is expected to grow stronger because of various economic and trade factors.

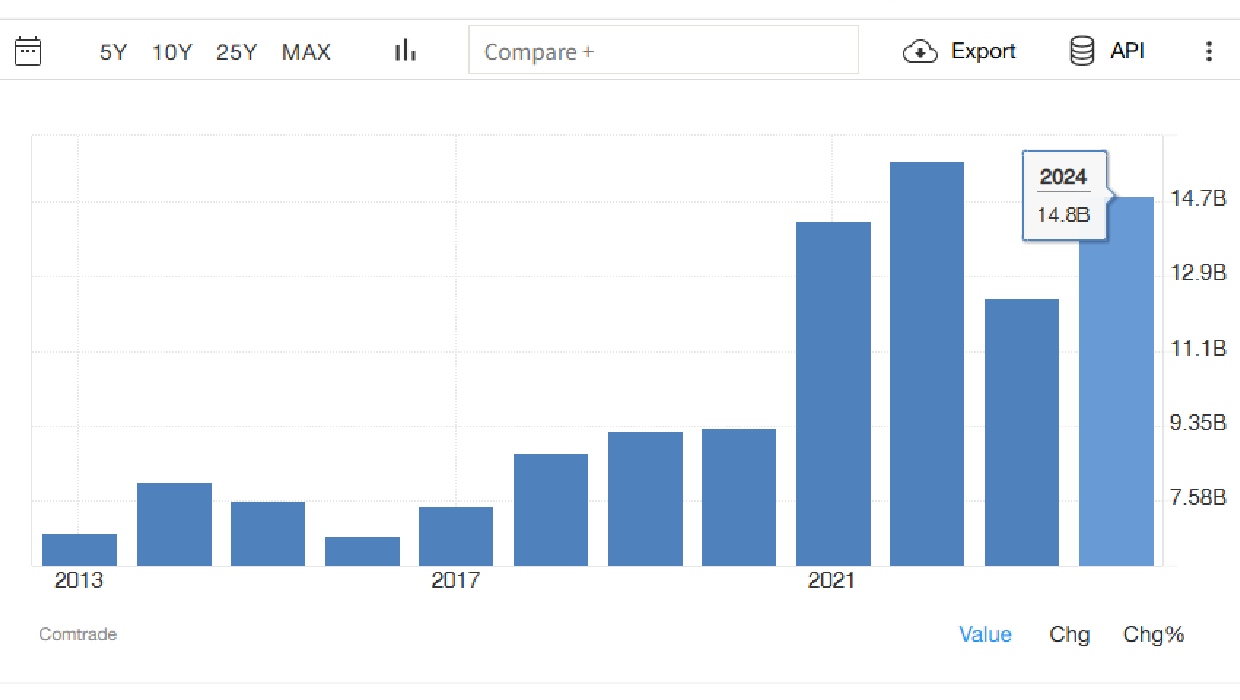

China's Exports to Colombia were US$14.78 billion during 2024, according to the United Nations COMTRADE database on international trade.

Top 10 categories:

|

China Exports to Colombia |

Value |

Year |

|

Electrical, electronic equipment |

$2.74B |

2024 |

|

Machinery, nuclear reactors, and boilers |

$2.22B |

2024 |

|

Vehicles other than railway, tramway |

$1.14B |

2024 |

|

Plastics |

$868.74M |

2024 |

|

Iron and steel |

$852.28M |

2024 |

|

Organic chemicals |

$615.31M |

2024 |

|

Articles of iron or steel |

$431.78M |

2024 |

|

Toys, games, sports requisites |

$391.17M |

2024 |

|

Rubbers |

$373.97M |

2024 |

|

Furniture, lighting signs, prefabricated buildings |

$368.95M |

2024 |

China is a top player in global manufacturing, providing a large variety of products at competitive prices. If you're a wholesaler or retailer, importing from China could be your best chance right now.

For Colombian companies, bringing in goods from China allows them to access advanced technology and quality products. This not only enhances what they can offer in the local market but also helps them compete more effectively. In today's globalized economy, staying competitive is key, and China offers the resources needed to do so.

Benefits of importing from China:

Diversifying suppliers and products.

Gaining access to innovations and advanced technologies.

Reducing costs with lower-priced products.

Enhanced competitiveness compared to other local businesses.

Furthermore, the enhancement of trade relations between Colombia and China presents new opportunities. Trade agreements facilitate transactions by lowering tariffs and streamlining procedures.

Importing goods from China is significant for Colombian businesses. It aids in their growth and boosts their competitiveness internationally. Taking advantage of these opportunities in 2025 could be key to long-term business success.

To begin importing from China to Colombia, start by performing detailed market research. Knowing what Colombian consumers want is essential for making smart choices. This helps ensure your imported products will have a market in Colombia.

Finding sectors with high demand and low competition is key. This strategy boosts the likelihood of success and maximizes profits.

Market analysis tools offer insights into current and upcoming trends. The goal is spotting opportunities before competitors do.

Three methods for analyzing market trends:

Digital Tools: Google Trends, TikTok Shops, AMZScout.

Social Trends: Instagram and TikTok influencers.

Hiring a Sourcing Agent: EJET Procurement.

After identifying the right market, the next step involves choosing the right products. Consider factors like quality, cost, and popularity.

Factors to weigh when picking products:

Market Demand: Does the product have a known market?

Regulations: Is it in line with Colombian rules?

Import Costs: Are the expenses manageable?

Reliable Suppliers: Are there dependable manufacturers or suppliers?

Both market research and product selection are crucial and shouldn't be rushed. Dedicate the necessary time and effort to evaluate your options and plans before progressing. If you're uncertain about which niche to pursue, consider seeking advice from EJET Procurement.

Tip:Be aware of Colombian regulations that might influence product imports.

Finding reliable suppliers in China is essential for successful importing. These suppliers ensure your products meet quality, availability, and pricing standards, which helps streamline the import process and boosts business success.

Begin your search on platforms like Alibaba and Global Sources to compile a list of potential manufacturers. These platforms offer filters to find certified suppliers that comply with international standards.

After identifying possible suppliers, it's important to verify their credibility. Check their credentials, like business registration and export licenses.

Communicating directly can help determine if they can fulfill your specific needs. Requesting quality certifications or third-party audits is another effective way to ensure safety.

Think about attending trade shows in China, such as the Canton Fair, to meet suppliers face-to-face and assess product quality. Trade fairs also provide insight into market trends and allow for direct negotiations.

If attending in person isn't feasible, consider hiring agents in China to visit factories. EJET Procurement offers professional Canton Fair tour services.

Essential supplier verification steps:

Certifications: Request evidence of quality certifications.

References: Ask for past client references.

Track record: Check how long they've been operating.

Capabilities: Confirm they can handle your required volumes.

Verifying supplier reliability helps ensure product quality and reduces fraud risks. Only proceed with negotiations when confident a supplier can meet your needs. Conducting thorough checks lays the foundation for a strong, lasting business relationship.

Navigating business relationships with Chinese suppliers is distinct from working with those in Colombia. Appreciating these cultural differences is crucial; emphasis is placed on fostering trust and building long-term connections rather than quick transactions.

During negotiations, showing respect and patience is vital. Chinese professionals prefer in-person meetings for developing personal ties. If feasible, travel to China to negotiate; it reflects genuine interest and commitment.

Tip: Be mindful of body language and etiquette during talks.

Your success might hinge on adapting to their negotiation approach. Here are some tips for managing cultural differences:

Communication: Maintain a formal tone and steer clear of direct language that could seem confrontational.

Patience: Prepare for potentially lengthy negotiations involving multiple meetings.

Flexibility: Be willing to make compromises and explore innovative solutions.

Adopting these practices can aid in bridging cultural gaps and building robust business relationships. Achieving successful negotiations isn't solely about the final agreement but also about nurturing a strong business partnership. By focusing on these relationships, you're likely to experience greater rewards in the long run.

Securing intellectual property (IP) when bringing goods from China is essential. Without protection, you could face big losses. Before you start importing, make sure your products are registered and secured in both countries. Get to know the IP laws in China and Colombia.

How to protect your IP:

Sign up for patents, trademarks, and copyrights.

Speak with a lawyer specializing in international trade.

Go over contracts carefully.

Add specific IP protection terms in supplier contracts.

Moreover, keep an eye on your supplier while you work with them. Oversee how your goods are used in the market. These methods help reduce the chance of unauthorized use of your IP.

Incoterms are vital terms for international trade. They specify what the buyer and seller are each accountable for during a transaction. Understanding Incoterms is essential to prevent misunderstandings during the import process.

These terms outline who is responsible for delivery, risk, and expenses. The right Incoterm can greatly impact overall import costs. For instance, EXW (Ex Works) means the buyer takes on most of the duties, while DDP (Delivered Duty Paid) implies the seller handles nearly all responsibilities.

Common Incoterms:

EXW (Ex Works): Seller has minimal responsibility.

FOB (Free on Board): Seller places goods on the ship; buyer manages the rest.

CIF (Cost, Insurance, and Freight): Seller pays for shipping and insurance to the port of arrival.

DDP (Delivered Duty Paid): Seller takes care of all obligations and costs.

Having clear purchase terms helps both parties coordinate better, making importing smoother and more efficient.

Selecting the appropriate shipping method is important. Sea freight and air freight each have their own pros and cons. Think about your priorities, like timing and your budget.

Sea freight: It's more cost-effective for big shipments and manages large volumes well, though it takes longer.

Air freight: It's quick and best for urgent or in-demand items, but it's pricier and can't handle as much volume.

Important points to keep in mind:

Cost: Sea shipping is less expensive but slower.

Delivery Speed: Air shipping is quicker but more costly.

Volume & Weight: Sea freight can handle larger shipments; air freight has limits on size.

Urgency: Opt for air if time is of the essence.

|

Type |

Cost |

Time |

Best for |

|

Sea Freight |

$3750/20-foot container |

38-40days |

Larger shipments |

|

Air Freight |

$8.00 per kg |

7-8days |

Urgent or high-value goods |

|

Express |

$20-$30 per kg |

2-5days |

Urgent shipments |

Evaluate your product features and logistics requirements. Deciding between sea and air shipping will greatly affect expenses and delivery times. Should you require freight forwarding services, EJET Procurement is highly knowledgeable in this field.

Customs clearance plays a crucial role in ensuring your goods are legally allowed entry into Colombia. You must be familiar with the necessary documentation and procedures to meet Colombian customs regulations.

Customs in Colombia enforce strict clearance rules, especially focusing on electronics, textiles, and consumer goods. Importers should carefully verify that all commercial invoices, packing lists, and bills of lading are correct and aligned to prevent costly delays.

For commercial imports into Colombia, you need to declare them using the Declaración de Importación via the DIAN (Dirección de Impuestos y Aduanas Nacionales). Generally, these declarations are filed by a licensed customs broker (Agencia de Aduanas).

Make sure to upload all essential commercial and regulatory documents through DIAN and VUCE's (Ventanilla Única de Comercio Exterior) electronic systems promptly to avoid delays and penalties.

Engaging a China sourcing agent can be advantageous, as they can manage customs clearance effectively, ensuring all documentation is correct and mitigating delays.

Key documents needed for customs clearance include:

Commercial Invoice: Includes full description, HS code, unit price, totals, Incoterm, and details of the exporter/importer.

Packing List: Contains weights, dimensions, and a breakdown of cartons/boxes (essential for container shipments).

Bill of Lading: The primary transport document.

Certificate of Origin: Necessary when preferential tariffs under trade agreements apply. Note: China shipments often do not qualify for tariff reductions in Colombia; always check the rules of origin.

Import Permits: Required for specific products such as food, plants, animal products, medicines, cosmetics, medical devices, chemicals, pesticides, and hazardous materials.

It's essential to understand and comply with customs regulations to avoid fines or legal troubles. Stay informed about regulatory updates and be well-prepared. Incorrect documentation might result in penalties or your shipment being detained.

Tip: Training or consulting with a trustworthy China sourcing agent can keep you informed about DIAN and VUCE policies, aiding in a more streamlined and effective import process.

Accurately figuring out import costs is vital for the survival of a business. These costs have several parts, with tariffs being a major component.

In Colombia, tariffs are determined by the type of product being imported. Beyond tariffs, there are also VAT and other applicable taxes. These figures change based on the trade agreements between Colombia and China at the time of import.

Precisely estimating import expenses is important for a business to remain viable. These costs involve various factors that need advance consideration.

Import taxes are a key part of calculating these costs. Here's a list to guide you through the main tax components to budget for in Colombia:

Import Duty (customs/GCD / MFN or specific): Colombia levies this tax on the value of goods upon arrival, usually 5--10% for electronics, 10--15% for textiles, and 0--20% for other items.

Import VAT (IVA): The standard VAT rate is 19% on the CIF value. For imports, the VAT base includes the customs value (CIF) plus customs duties.

Statistical Fee: Often around 0.05% of the CIF value.

Consumption Tax/Excise Taxes: For special items like alcohol, tobacco, certain vehicles, and luxury goods, extra taxes may be added.

Note: There are thresholds for small parcels. No customs duty typically applies if shipment value is below USD $200, though VAT (19%) is still required.

Knowing these factors helps with setting competitive prices and maintaining healthy margins. Research tariffs well to prevent financial issues.

When your products arrive in Colombia, having a correct receipt is necessary to ensure accuracy. Start by checking the delivery to verify that the products match what was initially agreed upon. This step is essential to maintain quality standards.

Quality control plays a crucial role in preventing issues with customers. Establishing a quality control system allows you to detect defects promptly. Ensure each product batch is thoroughly inspected.

Good inventory management is important for the success of your operations. Here are some steps to enhance this process:

Logging: Keep a record of every inventory item that comes in and goes out.

Product Rotation: Use a "first in, first out" approach to ensure products remain fresh.

Constant Monitoring: Utilize technology to monitor inventory levels in real-time.

Finally, proper storage is necessary to maintain product quality. Select a secure and well-equipped storage site. This helps avoid spoilage and makes product access easier when required.

Importing from China can present specific challenges and risks. To mitigate these, it's wise to thoroughly vet suppliers before finalizing any contract. Investigate references from past clients and verify the supplier's legal status through official documentation.

Crafting comprehensive contracts that clearly outline all terms is also beneficial. Ensure everything is documented in writing to prevent misunderstandings. Additionally, protecting intellectual property rights should be considered early on.

To further minimize risks, consider these steps:

Pre-audits: Visit the supplier's location to evaluate their facilities and processes.

Staged Payments: Pay in installments, contingent on reaching specific milestones.

Tip: Maintain clear and direct communication with the supplier during the importing process. Building a relationship based on trust and cooperation can help minimize the risk of fraud.

Importing goods from China can be costly, making effective cash flow management essential. There are various financing options for businesses engaged in importing.

A common choice is trade lines of credit, which let companies pay suppliers before they sell the goods. Factoring is another option, offering cash advances on pending invoices.

EJET Procurement provides a credit payment service to support cash flow management. This service can help you allocate funds to other crucial needs, enhancing financial flexibility.

Selecting the appropriate financing solution should align with your company's needs and financial standing. Evaluating each option carefully is crucial to ensure smooth import operations without financial difficulties.

Bringing products from China to Colombia might seem tough, but with a smart strategy, it becomes a beneficial move. The secret is in careful planning and having good communication with your suppliers in China.

Looking to start sourcing from China to Colombia? Get in touch with us for a free quote.

Related reading:

To clear customs, you will require a commercial invoice, a packing list, a bill of lading, a certificate of origin, and potentially special import permits. Plus, you'll need to submit an import declaration.

In Colombia, nearly all shipments are taxed. Typically, 5–10% for electronics, 10–15% for textiles, and 0–20% for other products. However, small packages valued under $200 are typically not subject to tariffs, but VAT (19%) still applies.

You can choose between sea freight, which is cheaper but takes longer, air freight, which is faster but more expensive, or using couriers. Make your choice based on the shipment size, cost, and delivery speed you require.

Your trusted partner for sourcing from china.